.. says the Governor of the Bank of England who was paid £400,000 last year without taking any risk.

Go ahead Sir Mervyn, tell us how much you are going to cut your pay.

"Have you met the cretins we have in Westminster? Do you think we can be worse than that?" --- Nigel Farage

|

|

|

|

|

Friday, 29 June 2012

Misbuying

Now, I would be the first to admit that the difference between a derivatives salesman and a 3 card Monte dealer is that one of them works in an airconditioned office, but I have to take exception to the FSA's charge that interest rate swaps or cap and collar swaps have been mis-sold. A contract is a contract, freely entered into a by willing participants, or so you would like to think. Maybe the contracts were mis-bought.

What happened was that banks salesmen offered customers the ability to protect themselves against a rise in interest rates. This would give them an advantage over their customers who didn't hedge. Instead of asking for an option premium to provide this interest rate insurance, the bank offered them a cap (limiting the most they could pay) and a collar (so that they paid something to the bank if the rate fell below the collar. In some cases the cap and collar were the same, giving an effective fixed rate of interest when the cost of the swap and the loan are taken together. The bank makes its money on the cap and collar because with the cap and collar in place it can do a bit extra of volatility trading (a bit complicated that, but don't worry).

The downside for the customer is that if interest rates fall (which they did), then the customers start paying the banks quite a lot. But their interest rate costs fall so they should end up paying about as much as they were on interest alone, or maybe a little less. The trouble is those pesky competitors who did not hedge who get the full benefit of the interest rate reduction. terminating the swap agreement would even things up, but to do that the bank needs to be paid all its discounted future profits, which is quite a lot. Better to stay in the deal.

Oh, and squeal to the FSA that the nasty man from the bank tricked you into getting out your pen and signing his application form.

What happened was that banks salesmen offered customers the ability to protect themselves against a rise in interest rates. This would give them an advantage over their customers who didn't hedge. Instead of asking for an option premium to provide this interest rate insurance, the bank offered them a cap (limiting the most they could pay) and a collar (so that they paid something to the bank if the rate fell below the collar. In some cases the cap and collar were the same, giving an effective fixed rate of interest when the cost of the swap and the loan are taken together. The bank makes its money on the cap and collar because with the cap and collar in place it can do a bit extra of volatility trading (a bit complicated that, but don't worry).

The downside for the customer is that if interest rates fall (which they did), then the customers start paying the banks quite a lot. But their interest rate costs fall so they should end up paying about as much as they were on interest alone, or maybe a little less. The trouble is those pesky competitors who did not hedge who get the full benefit of the interest rate reduction. terminating the swap agreement would even things up, but to do that the bank needs to be paid all its discounted future profits, which is quite a lot. Better to stay in the deal.

Oh, and squeal to the FSA that the nasty man from the bank tricked you into getting out your pen and signing his application form.

A few rogue traders

According to Bob Diamond, it was a big boy wot dunnit and he ran away.

The trouble is it is always somebody else's fault and they are too far down the organisation for it to be the responsibility of the CEO. But if Mr Diamond is not responsible for their actions, why does he trouser part of the profits they generate as his bonus.

The problem, as many are beginning to realise is not just one of risk, but also of culture.

Three years ago I wrote a blog blaming the entire financial crisis on Tie Rack. OK, it was a bit tongue in cheek, but the underlying message, that traders (who like to call themselves investment bankers) have taken over the previously sleepy and conservative banks and get to play all day with your government guaranteed deposits. The solution is to change the banks by separating out trading activities and to remove CEO's like Mr Diamond who in their entire banking lives have not lent a penny to a corner shop or engineering start up (unless their loans were wrapped up in securitised packaged of bankers acceptances and short term receivables), and replace them with honest lenders who at a minimum don't try to mess with regulators, statutory reporting, tax avoidance or rate reporting and fixings.

Three years ago I wrote a blog blaming the entire financial crisis on Tie Rack. OK, it was a bit tongue in cheek, but the underlying message, that traders (who like to call themselves investment bankers) have taken over the previously sleepy and conservative banks and get to play all day with your government guaranteed deposits. The solution is to change the banks by separating out trading activities and to remove CEO's like Mr Diamond who in their entire banking lives have not lent a penny to a corner shop or engineering start up (unless their loans were wrapped up in securitised packaged of bankers acceptances and short term receivables), and replace them with honest lenders who at a minimum don't try to mess with regulators, statutory reporting, tax avoidance or rate reporting and fixings.

Thursday, 28 June 2012

Done .... for you bigboy

There was a time when big banks didn't let traders near the senior executive washroom. The fear was that traders are natural predators, risk-takers, rule-benders who would stop at nothing to make a buck. Shame was that in the nineties and noughties, trading edged out and subsumed the rest of every bank. Here is why the earlier bankers' instincts were right (taken from the FSA report into Barclays):

We have another big fixing tom[orrow] and with the market move I was hoping we could set [certain] Libors as high as possible.

Requests to move Libor rates were frequently accepted by Barclays’ submitters, who emailed responses such as this, written in response to a swaps trader's request for a high one-month and low three-month US Dollar Libor on March 16, 2006:

Other responses included the phrases: “always happy to help” and “Done…for you big boy”.

For you ... anything. I am going to go 78 and 92.5. It is difficult to go lower than that in threes. looking at where cash is trading. In fact, if you did not want a low one I would have gone 93 at least.March 16, 2006, submitter's response to swaps trader's request for a high one-month and low three-month US Dollar Libor

[Senior trader] owes me! February 7, 2006, submitter's response when swaps trader called him a "superstar" for moving Barclays' US Dollar Libor submission up a basis point more than the submitter wanted and for making a submission with the intent to get "kicked out"According to the CFTC senior managers even coined the phrase “head above the parapet” to describe putting in high Libor submissions relative to other banks.

Sometimes, the traders asked the submitters to try to have Barclays excluded from the Libor calculation altogether by deliberately falling into the top or bottom quartile, in an attempt to influence the official fixing. Sometimes the requests covered several days or even weeks of submissions at a time.

WE HAVE TO GET KICKED OUT OF THE FIXINGS TOMORROW!! We need a 4.17 fix in 1m (low fix) We need a 4.41 fix in 3m (high fix) November 22, 2005, senior trader in New York to trader in London

You need to take a close look at the reset ladder. We need 3M to stay low for the next 3 sets and then I think that we will be completely out of our 3M position. Then its on. [Submitter] has to go crazy with raising 3M Libor. February 1, 2006, trader in New York to trader in London

Your annoying colleague again ... Would love to get a high 1m Also if poss a low 3m... ifposs ... thanks February 3, 2006, trader in London to submitter

This is the [book's] risk. We need low 1M and 3M libor. PIs ask [submitter] to get 1M set to 82. That would help a lot March 27,2006, trader in New York to trader in London

Hi Guys, We got a big position in 3m libor for the next 3 days. Can we please keep the libor fixing at 5.39 for the next few days. It would really help. We do not want it to fix any higher than that. Tks a lot. September 13, 2006, senior trader in New York to submitter

For Monday we are very long 3m cash here in NY and would like the setting to be set as low as possible ... thanksDecember 14, 2006, trader in New York to submitter

PIs. go for 5.36 Libor again tomorrow, very long and would be hurt by a higher setting ... thanks. May 23, 2007, trader in New York to submitter

The following are just some of the numerous examples of the communications between the traders and submitters:

June 1, 2006: Senior euro swaps trader: "Hi [Euribor Submitter], is it too late to ask for a low 3m?"

Euribor submitter: "Just about to put them in ..... so no."

September 7, 2006: Senior euro swaps trader: "I have a huge 1m fixing today and it would really help to have a low 1m tx a lot."

Euribor submitter: "I'll do my best."

Senior euro swaps trader: "because I am aware some other banle need a very high one ... .if you could push it very low it would help. I have 50bn fixing."

October 13, 2006: Senior euro swaps trader: "I have a huge fixing on Monday ... something like 30bn 1m fixing ... and I would like it to be very very very high ..... Can you do something to help? I know a big clearer will be against us ... and don't want to lose money on that one."

Euribor submitter forwarded the request to another Euribor submitter, advising: "We always try and do our best to help out. .... "

Senior euribor submitter to senior euro swaps trader: "By the way [euribor submitter] tells me that it would be good to see a high lmth fix on Monday, we will pay for some cash that morning so hopefully that will help."

January 12, 2007: Senior euro swaps trader: "hi [Euribor submitter]. we need a low 1m in the coming days if u can .... "

Senior euribor submitter: "hi [senior euro swaps trader], we will keep the 1mth low for a few days."

April 2, 2007: Euro swaps trader: "hello [Senior Euribor Submitter], could you please put in a high 6 month euribor today?"

Senior Euribor submitter: "will do."

July 29, 2008: Euro swaps trader to senior euro swaps trader: "I was discussing the strategy [to get a high fixing] with [Senior Euribor Submitter] earlier this morning - today he will stay bid in the mkt and put a high fixing but without lifting any offer, and then he will be really paying up for cash tomorrow and Thursday which is when the big positive resets are."

We have another big fixing tom[orrow] and with the market move I was hoping we could set [certain] Libors as high as possible.

Requests to move Libor rates were frequently accepted by Barclays’ submitters, who emailed responses such as this, written in response to a swaps trader's request for a high one-month and low three-month US Dollar Libor on March 16, 2006:

Other responses included the phrases: “always happy to help” and “Done…for you big boy”.

For you ... anything. I am going to go 78 and 92.5. It is difficult to go lower than that in threes. looking at where cash is trading. In fact, if you did not want a low one I would have gone 93 at least.March 16, 2006, submitter's response to swaps trader's request for a high one-month and low three-month US Dollar Libor

[Senior trader] owes me! February 7, 2006, submitter's response when swaps trader called him a "superstar" for moving Barclays' US Dollar Libor submission up a basis point more than the submitter wanted and for making a submission with the intent to get "kicked out"According to the CFTC senior managers even coined the phrase “head above the parapet” to describe putting in high Libor submissions relative to other banks.

Sometimes, the traders asked the submitters to try to have Barclays excluded from the Libor calculation altogether by deliberately falling into the top or bottom quartile, in an attempt to influence the official fixing. Sometimes the requests covered several days or even weeks of submissions at a time.

WE HAVE TO GET KICKED OUT OF THE FIXINGS TOMORROW!! We need a 4.17 fix in 1m (low fix) We need a 4.41 fix in 3m (high fix) November 22, 2005, senior trader in New York to trader in London

You need to take a close look at the reset ladder. We need 3M to stay low for the next 3 sets and then I think that we will be completely out of our 3M position. Then its on. [Submitter] has to go crazy with raising 3M Libor. February 1, 2006, trader in New York to trader in London

Your annoying colleague again ... Would love to get a high 1m Also if poss a low 3m... ifposs ... thanks February 3, 2006, trader in London to submitter

This is the [book's] risk. We need low 1M and 3M libor. PIs ask [submitter] to get 1M set to 82. That would help a lot March 27,2006, trader in New York to trader in London

Hi Guys, We got a big position in 3m libor for the next 3 days. Can we please keep the libor fixing at 5.39 for the next few days. It would really help. We do not want it to fix any higher than that. Tks a lot. September 13, 2006, senior trader in New York to submitter

For Monday we are very long 3m cash here in NY and would like the setting to be set as low as possible ... thanksDecember 14, 2006, trader in New York to submitter

PIs. go for 5.36 Libor again tomorrow, very long and would be hurt by a higher setting ... thanks. May 23, 2007, trader in New York to submitter

The following are just some of the numerous examples of the communications between the traders and submitters:

June 1, 2006: Senior euro swaps trader: "Hi [Euribor Submitter], is it too late to ask for a low 3m?"

Euribor submitter: "Just about to put them in ..... so no."

September 7, 2006: Senior euro swaps trader: "I have a huge 1m fixing today and it would really help to have a low 1m tx a lot."

Euribor submitter: "I'll do my best."

Senior euro swaps trader: "because I am aware some other banle need a very high one ... .if you could push it very low it would help. I have 50bn fixing."

October 13, 2006: Senior euro swaps trader: "I have a huge fixing on Monday ... something like 30bn 1m fixing ... and I would like it to be very very very high ..... Can you do something to help? I know a big clearer will be against us ... and don't want to lose money on that one."

Euribor submitter forwarded the request to another Euribor submitter, advising: "We always try and do our best to help out. .... "

Senior euribor submitter to senior euro swaps trader: "By the way [euribor submitter] tells me that it would be good to see a high lmth fix on Monday, we will pay for some cash that morning so hopefully that will help."

January 12, 2007: Senior euro swaps trader: "hi [Euribor submitter]. we need a low 1m in the coming days if u can .... "

Senior euribor submitter: "hi [senior euro swaps trader], we will keep the 1mth low for a few days."

April 2, 2007: Euro swaps trader: "hello [Senior Euribor Submitter], could you please put in a high 6 month euribor today?"

Senior Euribor submitter: "will do."

July 29, 2008: Euro swaps trader to senior euro swaps trader: "I was discussing the strategy [to get a high fixing] with [Senior Euribor Submitter] earlier this morning - today he will stay bid in the mkt and put a high fixing but without lifting any offer, and then he will be really paying up for cash tomorrow and Thursday which is when the big positive resets are."

It could only be Barclays

If I ever met a dishonest banker, chances are they had probably worked at Barclays, or maybe Lehman or some other second tier investment bank, but it was always Barclays that seemed to have a culture of dishonesty, in the same way that Arthur Andersen or Enron had that extra spiviness that set them apart from the rest. Barclays, as we know, used to make most of their money either from tax scams using their own tax position or by taking deals to other banks to use theirs. As a bank, they were never any good

And so it would seem from the reports of their alleged manipulation of the LIBOR and EURIBOR rates. What is that all about? Well if you have ever signed a floating rate loan or swap agreement with a bank (standard practice for companies), then you will see a clause explaining how the floating rate of interest is calculated. For a loan it is the LIBOR rate at 11 am on the fixing date, and that value is calculated as the average value as reported by a panel of banks as the rate at which they offered to take deposits at that time.

The theory being that by taking an average of several large banks, any blips in the market would be smoothed out, and because the rates at which they were offering to take deposits would be a matter of public record, any misreporting would eventually be discovered, so any bank that did so would not only be dishonest, but also stupid. Barclays, it appears, were both.

By reporting a higher LIBOR than they were offering, a bank would push up the marginal cost to floating rate borrowers. There could well be other instances when a big derivatives play might be "helped" by a lower reporting of LIBOR. The FSA reports don't go into detail of any losses but they do record emails demonstrating collusion. If the bank made money from it, then their customers and counterparties lost. Shame then that the government pockets the £290 million fine and doesn't pass it back to the customers.

Bob Diamond will forego his bonus for this year, but since the FSA has known about the problem since 2004, is there any chance he will be handing back his bonuses for the last 10 years? Fat chance.

And probably fat chance of any fraud prosecutions.In a world where you can get a long prison sentence for stealing a bag of rice, organising a demo to which know one turns up or assisting US Customs to break their own rules to export weapon components that don't exist, it seems that the punishment for systematic long term financial fraud by the chief executive of a bank is to have to settle for a £5 million salary, well £17 million when you count share scheme payouts, or make that £100 million since 2006.

In a statement Diamond said: "Nothing is more important to me than having a strong culture at Barclays. I am sorry that some people acted in a manner not consistent with our culture and values." Given Barclays, internal culture, it is easy to see Diamond's point. Barclays' "culture and values" have made him a lot of money over the years.

And so it would seem from the reports of their alleged manipulation of the LIBOR and EURIBOR rates. What is that all about? Well if you have ever signed a floating rate loan or swap agreement with a bank (standard practice for companies), then you will see a clause explaining how the floating rate of interest is calculated. For a loan it is the LIBOR rate at 11 am on the fixing date, and that value is calculated as the average value as reported by a panel of banks as the rate at which they offered to take deposits at that time.

The theory being that by taking an average of several large banks, any blips in the market would be smoothed out, and because the rates at which they were offering to take deposits would be a matter of public record, any misreporting would eventually be discovered, so any bank that did so would not only be dishonest, but also stupid. Barclays, it appears, were both.

By reporting a higher LIBOR than they were offering, a bank would push up the marginal cost to floating rate borrowers. There could well be other instances when a big derivatives play might be "helped" by a lower reporting of LIBOR. The FSA reports don't go into detail of any losses but they do record emails demonstrating collusion. If the bank made money from it, then their customers and counterparties lost. Shame then that the government pockets the £290 million fine and doesn't pass it back to the customers.

Bob Diamond will forego his bonus for this year, but since the FSA has known about the problem since 2004, is there any chance he will be handing back his bonuses for the last 10 years? Fat chance.

And probably fat chance of any fraud prosecutions.In a world where you can get a long prison sentence for stealing a bag of rice, organising a demo to which know one turns up or assisting US Customs to break their own rules to export weapon components that don't exist, it seems that the punishment for systematic long term financial fraud by the chief executive of a bank is to have to settle for a £5 million salary, well £17 million when you count share scheme payouts, or make that £100 million since 2006.

In a statement Diamond said: "Nothing is more important to me than having a strong culture at Barclays. I am sorry that some people acted in a manner not consistent with our culture and values." Given Barclays, internal culture, it is easy to see Diamond's point. Barclays' "culture and values" have made him a lot of money over the years.

Wednesday, 27 June 2012

Pay peanuts, get monkeys

Back during the last few years of the last millennium, the more enterprising or devious consulting companies made a small fortune by telling their clients that unless they were careful their computer systems could fall apart when the first digit of the year switched from a 1 to a 2.

As it turned out, although dates are widely used in computer programs, either all the developers figured out this once in a thousand year event when they were writing the code, or it was very easy to track down where dates were used and make sure there were no foul-ups. Net, net there were no great disasters on 1.1.2000.

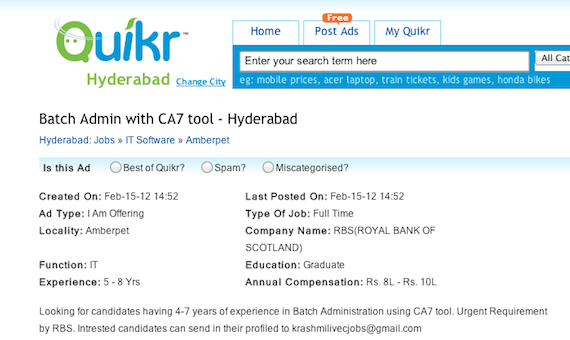

But come the next century, those consultants had to find something to do, and that turned out to be outsourcing. For £250 an hour a big consulting firm could tell a big bank how it could save money in the long term by firing its staff in the UK and replacing them with Indians who would be paid about the same as the UK minimum wage. A UK IT worker might be costing about £60-70k once all the NI, pension rights and the rest were factored in, plus the overhead, whereas an Indian graduate with 5-8 years experience would cost about 10k (see above).

Which is all a shame when the system goes tits up because some junior operator in India, unsupervised by anyone in the UK, screws up a system update, places the same update on the live and the back up machines and then messes up the back out of those updates.

The outcome: a fall in the value of the shares owned by you (as a tax payer) of £1.7 billion, which dwarves any costs or losses due to the Millennium bug.

Tuesday, 26 June 2012

What we can learn from Sarf Lundun

Recently the Parliamentary Treasury Select Committee found that ""PFI should be brought on balance sheet. The Treasury should remove any perverse incentives unrelated to value for money by ensuring that PFI is not used to circumvent departmental budget limits. It should also ask the OBR to include PFI liabilities in future assessments of the fiscal rules".

By October 2007 the total capital value of PFI contracts signed throughout the UK was £68bn, committing the British taxpayer to future spending of £215 bn over the life of the contracts. The global financial crisis which began in 2007 presented PFI with difficulties because many sources of private capital had dried up. Nevertheless PFI remained the UK government's preferred method for public sector procurement under both Labour and the present coalition. In January 2009 the Labour Secretary of State for Health, Alan Johnson, reaffirmed this commitment with regard to the health sector, stating that “PFIs have always been the NHS’s ‘plan A’ for building new hospitals … There was never a ‘plan B’".

However, because of banks' unwillingness to lend money for PFI projects, the UK government now had to fund the so-called 'private' finance initiative itself. In March 2009 it was announced that the Treasury would lend £2bn of public money to private firms building schools and other projects under PFI.

Labour's Chief Secretary to the Treasury, Yvette Cooper, claimed the loans should ensure that projects worth £13bn — including waste treatment projects, environmental schemes and schools — would not be delayed or cancelled. She also promised that the loans would be temporary and would be repaid at a commercial rate. But, at the time, Vince Cable of the Liberal Democrats, subsequently Secretary of State for Business in the coalition, argued in favour of traditional public financing structures instead of propping up PFI with public money:

The whole thing has become terribly opaque and dishonest and it's a way of hiding obligations. PFI has now largely broken down and we are in the ludicrous situation where the government is having to provide the funds for the private finance initiative.

In opposition at the time, even the Conservative Party considered that, with the taxpayer now funding it directly, PFI had become "ridiculous". Philip Hammond, subsequently Secretary of State for Transport in the coalition, said:

If you take the private finance out of PFI, you haven’t got much left . . . if you transfer the financial risk back to the public sector, then that has to be reflected in the structure of the contracts. The public sector cannot simply step in and lend the money to itself, taking more risk so that the PFI structure can be maintained while leaving the private sector with the high returns these projects can bring. That seems to us fairly ridiculous.

In an interview in November 2009, Conservative George Osborne, subsequently Chancellor of the Exchequer in the coalition, sought to distance his party from the excesses of PFI by blaming Labour for its misuse, despite it still bearing all the hallmarks of the policy devised by his own party. At the time, Osborne proposed a modified PFI which would preserve the arrangement of private sector investment for public infrastructure projects in return for part-privatisation, but would ensure proper risk transfer to the private sector along with transparent accounting:

Labour's PFI model is flawed and must be replaced. We need a new system that doesn't pretend that risks have been transferred to the private sector when they can't be, and that genuinely transfers risks when they can be . . . On PFI, we are drawing up alternative models that are more transparent and better value for taxpayers. The first step is transparent accounting, to remove the perverse incentives that result in PFI simply being used to keep liabilities off the balance sheet. The government has been using the same approach as the banks did, with disastrous consequences. We need a more honest and flexible approach to building the hospitals and schools the country needs. For projects such as major transport infrastructure we are developing alternative models that shift risk on to the private sector. The current system – heads the contractor wins, tails the taxpayer loses – will end.

Despite being so critical of PFI while in opposition and promising reform, once in power George Osborne progressed 61 PFI schemes worth a total of £6.9bn in his first year as Chancellor. The truth is the coalition government have made a decision that they want to expand PFI at a time when the value for money credentials of the system have never been weaker. The government is very concerned to keep the headline rates of deficit and debt down, so it's looking to use an increasingly expensive form of borrowing through an intermediary knowing the investment costs won't immediately show up on their budgets.

So what do we learn from South London NHS? First of all that PFI is expensive, cripplingly expensive. Second that it doesn't transfer any risk At all. None, whatsoever. A private sector gopher may be replacing all the light bulbs at £200 a pop, if you'll pardon the expression, but there is no real transfer of risk because the public sector always needs the service, so when the public sector service recipient goes tits up, who steps in? Answer: you the tax payer, because the contingent liability loses its tingency (making the con very visible).

So why does the government persist in keeping PFI liabilities off the government balance sheet?

Monday, 25 June 2012

Reasons not to join the Euro

1. Staying out probably means that Blair won't be President of Europe.

I think that's enough

I think that's enough

Hester, Hester, Hester, Out, Out, Out

A NatWest Spokesman tells us:

Glad to know it is technical, not biological, but 'technical' carriues the implication, that they don't know what the problem is. However, the problem is believed to have arisen following a software update to the payment processing systems of Natwest's parent company RBS.

According to a spokesman from Compuware, whoever they may be:

Train A goes something like:

We employ 1,000 IT staff and, because of this, all our systems run smoothly.

Train B, however, goes:

All our systems run smoothly, why do we need 1,000 IT staff?

Unfortunately, it's standing room only on Train B, while Train A has been cancelled due to lack of demand and a bus replacement service is now in operation.

On the plus-side, all RBS Group employees are forced to have an RBS/Natwest account into which their salary will be paid. This happens around the 24th of each month, which this month falls on a Sunday, so payments would be made the following working day. Which would be today.

How's your bank balance looking today Mr Hester?

We are continuing to experience technical issues with our systems, which is impacting a large number of our customers. As a result, money credited to accounts overnight may not be appearing on balances today.Which is a great way to tell us about our relationship with our money, and how it is handled, but there is more. NatWest re-iterated that the problem is “strictly of a technical nature”, although it declined to provide further detail on the issues it faces.

Glad to know it is technical, not biological, but 'technical' carriues the implication, that they don't know what the problem is. However, the problem is believed to have arisen following a software update to the payment processing systems of Natwest's parent company RBS.

According to a spokesman from Compuware, whoever they may be:

The problem is that IT systems have become vastly more complex. Delivering an e-banking service could be reliant on 20 different IT systems. If even a small change is made to one of these systems, it can cause major problems for the whole banking service, which could be what’s happened at NatWest. Finding the root cause of the problem is probably something NatWest is struggling with because of the complexity of the IT systems in any bank.All the more reason then to keep the IT department in house. However that is not how it works. NatWest/RBS have fired thousands of back room staff and outsourced their jobs to India. In modern business there are two trains of thought that exist in management.

Train A goes something like:

We employ 1,000 IT staff and, because of this, all our systems run smoothly.

Train B, however, goes:

All our systems run smoothly, why do we need 1,000 IT staff?

Unfortunately, it's standing room only on Train B, while Train A has been cancelled due to lack of demand and a bus replacement service is now in operation.

On the plus-side, all RBS Group employees are forced to have an RBS/Natwest account into which their salary will be paid. This happens around the 24th of each month, which this month falls on a Sunday, so payments would be made the following working day. Which would be today.

How's your bank balance looking today Mr Hester?

Friday, 15 June 2012

Let's play a game

So the president of Argentina, Cristina Fernandez de Kirchner has demanded that Britain enter negotiations over the sovereignty of the Falkland Islands. Funny name for an Argentinian, Kirchner. Sounds almost German. Well actually it is, but let us leave that aside for the moment.

Let's play a game. Charades. I'll start. Well known phrase. Two words. Second word: off.

The British know all about Argentinians and Germans who want to help themselves to bits of other people's countries. We are on a 3 match winning streak and I think we would look to be favourites in this game.

Wednesday, 13 June 2012

Klutz of the day

You can tell how an iundependent Scotland would be run by the calibre of the people running Scottish businesses, siuch as the banks and its larger football clubs. In both cases, downright appalling. Considering how easy it is for the top 2 clubs to stay in business with the almost hitherto guaranteed dose of Euro TV money, it takes a real incompetent to put one of them out of business,.

But it seems another kilted-know-nothing is lining up to set up a new Glasgow Rangers, and this particular numbskull thinks he can force the existing Rangers players to play for his new club under the TUPE rules.

Not so fast, Mr Green. The TUPE rules are their to protect employees' rights not to allow employers to coerce them into working for them.

As a general rule it is not legal to assign, sell or transfer an employment contract (i.e. McDonalds can’rt just package up all the employment contracts of all their staff and sell them to KFC). This is because to do so could amount to trading in people (i.e. slavery or indentures) which as a civilised person we do not do.

The exception to this is when a business, but not a company, is sold or even where a company or organisation stops doing something and a new party takes over the operation. In those circumstances it seems reasonable that the employees can expect that they will be transferred with the business so that they keep their jobs, and to the maximum extent possible keep their terms and conditions of employment.

But since it would be unreasonable to expect every employee would always want to work for the new employee, the law gives them the right to opt out. But it never made it legal for employers to sell their staff in other circumstances. But when the putative transferor is insolvent TUPE does not apply, so while the employee gets no protection from TUPE, but the transfer of the contract would not be binding on the employee. without consent. It simply lapses when the transferor is liquidated.

But it seems another kilted-know-nothing is lining up to set up a new Glasgow Rangers, and this particular numbskull thinks he can force the existing Rangers players to play for his new club under the TUPE rules.

Not so fast, Mr Green. The TUPE rules are their to protect employees' rights not to allow employers to coerce them into working for them.

As a general rule it is not legal to assign, sell or transfer an employment contract (i.e. McDonalds can’rt just package up all the employment contracts of all their staff and sell them to KFC). This is because to do so could amount to trading in people (i.e. slavery or indentures) which as a civilised person we do not do.

The exception to this is when a business, but not a company, is sold or even where a company or organisation stops doing something and a new party takes over the operation. In those circumstances it seems reasonable that the employees can expect that they will be transferred with the business so that they keep their jobs, and to the maximum extent possible keep their terms and conditions of employment.

But since it would be unreasonable to expect every employee would always want to work for the new employee, the law gives them the right to opt out. But it never made it legal for employers to sell their staff in other circumstances. But when the putative transferor is insolvent TUPE does not apply, so while the employee gets no protection from TUPE, but the transfer of the contract would not be binding on the employee. without consent. It simply lapses when the transferor is liquidated.

Monday, 11 June 2012

No idea what this means

Well actually I think it is something to do with an "initiative" (πρωτοβουλία) by "journalists" (δημοσιογράφων), but I like this free advertising from Greece.

Sunday, 10 June 2012

Our politicians aren't alone

Our politicians certainly come up with a lot of tripe from time to time, but they have competition in that field.

Spanish Prime Minister Mariano Rajoy has hailed a decision by eurozone finance ministers to help Spain shore up its struggling banks as a victory for the European common currency. "It was the credibility of the euro that won," he told reporters.

And, presumably, the credibility of the Spanish PM that lost. After all only two weeks ago he was telling the world that Spain didn't need a bail out.

Pull the other one Pedro. How does an inter-government loan to several nearly bust financial institutions represent a victory for the currency? If the Spanish banks had been able to borrow in the public markets in their own currency, that would have been a victory for the currency, albeit a very minor one.

If that is a victory, lend me a billion, and win again

Spanish Prime Minister Mariano Rajoy has hailed a decision by eurozone finance ministers to help Spain shore up its struggling banks as a victory for the European common currency. "It was the credibility of the euro that won," he told reporters.

And, presumably, the credibility of the Spanish PM that lost. After all only two weeks ago he was telling the world that Spain didn't need a bail out.

Pull the other one Pedro. How does an inter-government loan to several nearly bust financial institutions represent a victory for the currency? If the Spanish banks had been able to borrow in the public markets in their own currency, that would have been a victory for the currency, albeit a very minor one.

If that is a victory, lend me a billion, and win again

Sunday, 3 June 2012

21 June is Visit your Doctor Day

Doctors have voted to go on strike on June 21. Their union, the British Medical Association, which is just a fancy name for a trade union, insists that the “industrial action” (their term, I'd called non-industrial inaction, but there you go) won’t harm anyone, so no doctor will break the Hippocratic Oath, which includes the clause “do no harm”.

The trouble is that doctors of course do a lot of harm to the economy, so be sure to make an urgent appointment with your GP to tell them that their high pay is an unnecdessary burden on the state. One of the post war socialists in government, I can't remember which, could have been a Bevin or a Bevan, warned that nationalising doctors could lead to doctors holding the government to ransom.

Doctors do a very valuable job; a job that requires a lot of training, paid for mostly by us, the tax payers. After that training they earn an average salary of over £100,000 a year, a pension after 40 years service worth over £50,000 index-linked and a £150,000 lump sum on retirement. Sounds pretty good to me, particularly considering the pension contributions of 8% over 40 years amount to 3 years salary, in return for which they will get a lump sum of 18 months salary and an expectation of 20 to 25 years pension. And becaus ethey might lose some of that they want to go on strike.

It is worth noting that half of the 1% of the most highly paid public sector workers work in the Health Service. Healthcare takes a disproportionate share of the national income and the reason is that like many public services, and unlike the private sector, it doesn't respond to market conditions.

Wagers iun the private sector have been driven down by competition from Asia. If you don't believe me, look at the wages in semiconductor fabrication. nott so long ago, we actually had some of those plants in the UK. Nowadays, they are all in the Far East. I rest my case.

but the doctors still think they should be paid as though they are servicing the healthcare needs of a vibrant workforce, when realistically it is more to do with hip operations of an ageing population. Sureenough they deserve care, but economically it ain't worth paying a lot for it, and by rights doctors should be earning a lot less when the government is running a deficit.

The docors may not like it, but part of the problem is that the costs of caring for the elderly have to be spread more thinly because we are all living longer, and the only people to blame for that are the doctors.

The trouble is that doctors of course do a lot of harm to the economy, so be sure to make an urgent appointment with your GP to tell them that their high pay is an unnecdessary burden on the state. One of the post war socialists in government, I can't remember which, could have been a Bevin or a Bevan, warned that nationalising doctors could lead to doctors holding the government to ransom.

Doctors do a very valuable job; a job that requires a lot of training, paid for mostly by us, the tax payers. After that training they earn an average salary of over £100,000 a year, a pension after 40 years service worth over £50,000 index-linked and a £150,000 lump sum on retirement. Sounds pretty good to me, particularly considering the pension contributions of 8% over 40 years amount to 3 years salary, in return for which they will get a lump sum of 18 months salary and an expectation of 20 to 25 years pension. And becaus ethey might lose some of that they want to go on strike.

It is worth noting that half of the 1% of the most highly paid public sector workers work in the Health Service. Healthcare takes a disproportionate share of the national income and the reason is that like many public services, and unlike the private sector, it doesn't respond to market conditions.

Wagers iun the private sector have been driven down by competition from Asia. If you don't believe me, look at the wages in semiconductor fabrication. nott so long ago, we actually had some of those plants in the UK. Nowadays, they are all in the Far East. I rest my case.

but the doctors still think they should be paid as though they are servicing the healthcare needs of a vibrant workforce, when realistically it is more to do with hip operations of an ageing population. Sureenough they deserve care, but economically it ain't worth paying a lot for it, and by rights doctors should be earning a lot less when the government is running a deficit.

The docors may not like it, but part of the problem is that the costs of caring for the elderly have to be spread more thinly because we are all living longer, and the only people to blame for that are the doctors.

Subscribe to:

Comments (Atom)