The Hester story at RBS has many parallels with the way the Labour government shafted Eric Daniels at Lloyds.

Prior to the financial crisis Hester had left banking and was running British Land, for which job he was no doubt handsomely rewarded. Come the fall of RBS, due at least in part to a failure of UK bank supervision, Hester is appointed to his position in RBS. The package is a little on the lavish side, but then you have pay up in order to get somebody above the average and Hester clearly fits that bill. Three years later, Miliband and Chuka Umunna are laying into him, not for his performance but because of his outrageous compensation package, negotiated by the government that they supported.

The similarity with Daniels is remarkable. Daniels was running Lloyds which probably had a few problems going into the financial crisis but nothing like the scale of HBOS or RBS. Actually that is probably a little unfair on lloys. It was a conservatively run bank with a very low risk portfolio. Daniels was running that quite nicely and no doubt being handsomely rewarded for running a steady ship.

Then comes the hand of Brown on his shoulder asking Daniels to do the country a favour by taking on the basket case that was HBOS. The country needed the strength and conservative approach of his bank to clean up the mess (that the government had supervised for the previous 10 years). So as well as running his old bank, Daniels took on the task of running a much bigger bank, but at the same salary.

But this was not enough for Labour politicians who lambasted Daniels for being paid so much while running a bank that had been bailed out by the government, overlooking the reality that what they had actually done was to swamp Daniels' nicely run bank in a pile of crap and expected him to do their dirty work of sorting it out using Lloyds equity cushion until that got wiped out by HBOS losses and the merged group needed a bail out.

Of course RBS shares opened nearly 3% down on the day so that saving £900k (£450k after tax) the Labour way has cost the country £700 million.

Yet another reason why another Labour government would be the final nail in the coffin of this country.

"Have you met the cretins we have in Westminster? Do you think we can be worse than that?" --- Nigel Farage

|

|

|

|

|

Monday, 30 January 2012

Sunday, 29 January 2012

Taxing times ahead for the Scots

OK here is a bit of boring UK tax legislation, which won't interest most of you unless you happen to own or work for a Scottish company, but under current

UK legislation, an exit charge (capital gains, plant and machinery balancing

charges and profit on deemed disposal of stock in trade) may arise when a

company ceases to be resident in the United Kingdom.

The exit charge is calculated on the unrealised capital gains of the company and

the cumulative difference between the fair value of plant and machinery and the

balance of unclaimed expenditure qualifying for writing down allowances.

The company is deemed to dispose of all of its assets (including goodwill and

shares in subsidiaries) at their open market value immediately before leaving

the United Kingdom, and to re-acquire them immediately after ceasing to be

within the charge to corporation tax.

A company that ceases to be within the charge to corporation is deemed to discontinue

its trade (at least for UK tax purposes). A further UK tax consequence of a deemed cessation of trade will be that the

company will be deemed to dispose of its trading stock at open market value,

which may give rise to a further tax charge.

This isn't at all unfair. After all the company will have probably claimed capital allowances in excess of the amount that it has depreciated the same assets in its accounting books, and it may well have unrealised capital gains, so fair enough if the UK authorities want to set things straight when it ceases to be a UK tax payer. That is exactly what has happened with every other company that has "emigrated" from the UK tax net in the last many, many years.

There is of course no difference if a company ceases to be UK tax resident by virtue of part of the UK becoming independent.

Can the

government assure all the remaining UK tax payers that such rules will continue

to be applied and enforced in the event of Scottish independence?

Can the

government state what measures will be made by HMRC to ensure the collection of

any amounts that might be owed following a company ceasing to be UK resident?

Will the

government be advising any companies currently headquartered, controlled and

managed in Scotland to move their headquarters south of the border prior to

independence in order to avoid any exit charges that would arise if such a move

south was made after independence?

I think we need to know.

You read it here first

Goodwin shares with James Crosby the distinction that both rose to the top of a large bank with very little experience of banking. And quite frankly it shows. Crosby came from investment management and operations whilst Goodwin came from accountancy and the BCCI workout, via Clydesdale Bank's operations. It may not be blindingly obvious but the skills required for investment management and accounting are very different from those required for banking.

Who wrote that? I did, two years ago, here. And on reflection I may have been too polite, but never mind.

But surprise, surprise, this week we read that a direct criticism of Sir Fred Goodwin in the Financial Services Authority's report on the near-collapse of RBS was removed after a final draft was shown to the former banking boss's lawyers. One of the two independent experts appointed by Parliament to review the FSA inquiry revealed that a reference to the RBS chief executive having insufficient experience to run an international bank was cut from the text after complaints from Sir Fred's legal team.

But lawyer Bill Knight told the Commons Treasury Committee that the change was "fair", as the reference amounted to a charge of incompetence for which no evidence was provided in last month's report. Which is about as much of a cop out as you can expect these days. The lawyers objected object because they say that saying Goodwin lacked experience was tantamount to a charge of incompetence.

That is a master class in spin because it didn't actually refute the charge that Goodwin didn't have the relevant experience. But to admit as much would bring shame on all those City grandees and FSA execs and ministers who considered Goodwin's appointment.

Who wrote that? I did, two years ago, here. And on reflection I may have been too polite, but never mind.

But surprise, surprise, this week we read that a direct criticism of Sir Fred Goodwin in the Financial Services Authority's report on the near-collapse of RBS was removed after a final draft was shown to the former banking boss's lawyers. One of the two independent experts appointed by Parliament to review the FSA inquiry revealed that a reference to the RBS chief executive having insufficient experience to run an international bank was cut from the text after complaints from Sir Fred's legal team.

But lawyer Bill Knight told the Commons Treasury Committee that the change was "fair", as the reference amounted to a charge of incompetence for which no evidence was provided in last month's report. Which is about as much of a cop out as you can expect these days. The lawyers objected object because they say that saying Goodwin lacked experience was tantamount to a charge of incompetence.

That is a master class in spin because it didn't actually refute the charge that Goodwin didn't have the relevant experience. But to admit as much would bring shame on all those City grandees and FSA execs and ministers who considered Goodwin's appointment.

The vexed question of the Orkney and Shetland Isles

It seems that there are a few more isseus that the government may want to consider in the event of a referendum in Scotland in favour of independence. This one concerns a matter of housekeeping going back over 550 years, and in the interest of keeping on good terms with our North European naighbours it is a matter that any sensible government should resolve before the Salmond government thinks it controls Orkney and Shetland

As keen historians will be aware, Princess Margaret of Denmark was betrothed to James of Scotland in 1460. The marriage was arranged by recommendation of the king of France to end the feud between Denmark and Scotland about the taxation of the Hebrides islands, a conflict that raged between 1426 and 1460. In July 1469 she married James III, King of Scots (1460–88) at Holyrood Abbey.

Her father, King Christian I of Denmark and Norway (and for a period of time, Sweden), agreed to a considerable dowry of 60,000 Rhenish Guilders. The first 10,000 was payable in cash, and the remainder was promised by Christain I backed by a pledge of Orkney as security. In the event, King Christian was only able to pay 2,000 Guilders immediately, so the promise of the remaining 8,000 Guilders was secured by a pledge of Shetland.

The money owed by King Christian had still not been paid three years later, so the Scottish Parliament passed an Act annexing both Orkney and Shetland to Scotland. It seems a little dubious that the Scottish Parliament could annex a body of land which was actually pledged as security for a debt owed to the monarch in a personal capacity rather than to the government, and the situation was clarified by the 1669 Act of Annexation of Orkney and Shetland to the Crown, which specifically removed Orkney and Shetland from the jurisdiction of the Scottish Parliament and placed it firmly in the care of the Crown. Even so, the claim to the land as a possession still seems somewhat tenuous and it could well be argued that the pledge was not a pledge of title but a usufruct, a right to enjoy the fruits of posession.

Nowadays, it seems unsatisfactory that this matter should be left unresolved with our Norwegian and Danish neighbours while the Scots contemplate their independence. My suggestion is that in the event of a vote for independence Her Majesty’s Treasury should offer the Norwegian government the opportunity to settle the outstanding balance of the dowry in return for a release 0of the pledge.

I estimate that 58,000 Rhenish guilders would be worth approximately £1,392,000 in modern currency, but it would also be reasonable to charge a rate of interest on top of that sum. Assuming a real interest rate of 2.125%, payable since the death of Christian I in 1481, that would give an outstanding balance £98,348,595,286.

While that might seem a very large sum, I understand that there are oil reserves around the islands which might make that an attractive proposition for the Norwegians. Nor is it beyond the capacity of the Norwegians to pay such a sum. The Statens pensjonsfond - Utland (commonly known as the Oil Fund) currently holds investments valued at $570 billion. Spending some of that to acquire oil fields adjacent to their existing oil industry would seem to make sense for them. For this country it would represent not only a satisfactory settlement of a long standing dispute, but it would generate a substantial reduction of the National Debt.

This would obviously be to the benefit of an independent Scotland because they would see a reduction in the proportionate share of the National Debt that they would be required to assume on independence.

As keen historians will be aware, Princess Margaret of Denmark was betrothed to James of Scotland in 1460. The marriage was arranged by recommendation of the king of France to end the feud between Denmark and Scotland about the taxation of the Hebrides islands, a conflict that raged between 1426 and 1460. In July 1469 she married James III, King of Scots (1460–88) at Holyrood Abbey.

Her father, King Christian I of Denmark and Norway (and for a period of time, Sweden), agreed to a considerable dowry of 60,000 Rhenish Guilders. The first 10,000 was payable in cash, and the remainder was promised by Christain I backed by a pledge of Orkney as security. In the event, King Christian was only able to pay 2,000 Guilders immediately, so the promise of the remaining 8,000 Guilders was secured by a pledge of Shetland.

The money owed by King Christian had still not been paid three years later, so the Scottish Parliament passed an Act annexing both Orkney and Shetland to Scotland. It seems a little dubious that the Scottish Parliament could annex a body of land which was actually pledged as security for a debt owed to the monarch in a personal capacity rather than to the government, and the situation was clarified by the 1669 Act of Annexation of Orkney and Shetland to the Crown, which specifically removed Orkney and Shetland from the jurisdiction of the Scottish Parliament and placed it firmly in the care of the Crown. Even so, the claim to the land as a possession still seems somewhat tenuous and it could well be argued that the pledge was not a pledge of title but a usufruct, a right to enjoy the fruits of posession.

Nowadays, it seems unsatisfactory that this matter should be left unresolved with our Norwegian and Danish neighbours while the Scots contemplate their independence. My suggestion is that in the event of a vote for independence Her Majesty’s Treasury should offer the Norwegian government the opportunity to settle the outstanding balance of the dowry in return for a release 0of the pledge.

I estimate that 58,000 Rhenish guilders would be worth approximately £1,392,000 in modern currency, but it would also be reasonable to charge a rate of interest on top of that sum. Assuming a real interest rate of 2.125%, payable since the death of Christian I in 1481, that would give an outstanding balance £98,348,595,286.

While that might seem a very large sum, I understand that there are oil reserves around the islands which might make that an attractive proposition for the Norwegians. Nor is it beyond the capacity of the Norwegians to pay such a sum. The Statens pensjonsfond - Utland (commonly known as the Oil Fund) currently holds investments valued at $570 billion. Spending some of that to acquire oil fields adjacent to their existing oil industry would seem to make sense for them. For this country it would represent not only a satisfactory settlement of a long standing dispute, but it would generate a substantial reduction of the National Debt.

This would obviously be to the benefit of an independent Scotland because they would see a reduction in the proportionate share of the National Debt that they would be required to assume on independence.

Saturday, 28 January 2012

There goes nothing

For all the pontificating by the press over the Chairman of RBS giving up his "bonus", they have all managed to overlook on the thing that paints a different picture: the facts.

Philip Hampton was offered options over 5,200,000 RBS shares when he became Chairman. He hadn't asked for the option but it had been offered to a prior candidate so the government offered to Hampton too. This was a somewhat unique arrangement because non-exec directors don't usually get a performance bonus, but never mind.

The important thing is that this was not an award of deferred shares but call options with a strike price of 28.2p. That may have sounded like a good deal for Hampton at the time they were offered because the RBS share price was around 50p, so there was already 22p or so of upside built into the option price.

The trouble is that now the shares have (or could have) vested the RBS share price has dropped to 27.7p - making the options worth precisely nothing.

So it isn't such a big deal from Mr Hampton to walk away from them.

Philip Hampton was offered options over 5,200,000 RBS shares when he became Chairman. He hadn't asked for the option but it had been offered to a prior candidate so the government offered to Hampton too. This was a somewhat unique arrangement because non-exec directors don't usually get a performance bonus, but never mind.

The important thing is that this was not an award of deferred shares but call options with a strike price of 28.2p. That may have sounded like a good deal for Hampton at the time they were offered because the RBS share price was around 50p, so there was already 22p or so of upside built into the option price.

The trouble is that now the shares have (or could have) vested the RBS share price has dropped to 27.7p - making the options worth precisely nothing.

So it isn't such a big deal from Mr Hampton to walk away from them.

It could be far worse

He's come a long way since the Addams Family, but Uncle Fester is copping a lot of grief over his £1.2 million salary and £0.9 million bonus. Not much for a modern bank CEO with a balance sheet the size of a medium sized European country, but sizeable nonetheless.

The man or woman on the Clapham omnibus might question the wisdom of paying him the about as much as the average South American midfielder could earn at a Lancashire mill town football club, but the responsibility of stewarding the country's £45 billion investment in a basket case Scottish bank (not to mention the interests of the other 18% shareholders who would also like to see a dividend or two) would seem to justify more pay than the requirement to beat the defender and whip the ball across on the left foot.

The attacks on Mr Hester are scurrilous (but no worse than the pillorying of Eric Daniels), and it is to Mr Hester's credit that he doesn't flounce off to spend more time with his family. The attacks from Labour politicians are even more scurrilous in that they invited Mr Hester in to run the bank, not on the understanding that it would be operated as a branch of the Treasury but as a fully commercial bank making daily commercial decisions and responding to the needs of the market.

If they had wanted a cheaper option, they should have put a civil servant or quangocrat into the job, but as they well knew at the time, that would have cost them billions.

As the board has since discovered, finding a suitable replacement for Hester will not be easy, and the right man (or woman) will probably cost them much more. And in view of the negative publicity from the press, much, much more.

Charity begins at the checkout

British banks tend to have characteristics to which they have conformed over the years: NatWest - low-grade ambition, RBS - reckless, Barclays - nothing outside their tax department and Lloyds - conservatively stupid.

And Lloyds have confirmed their reputation, garnering the additional award of Scrooge-of-the-year-so-far, by withdrawing their charity credit cards after 23 years of operating them. Charity credit cards, which are still offered by other providers such as MBNA and the Cooperative Bank, work by donating a small percentage of the amount spent on them to charity. Typically the charity also receives a larger amount th first time that the card is used.

Their reason? Because it is uneconomical. Yes, well charity rarely is profitable, but if that is the only reason you have got, then one has to question why it was done in the first place.

But not to fear, because Lloyds say they will help charities to find other card issuers who will gladly accept the card business that Lloyds says is unprofitable. As though any other company would be so stupid.

And Lloyds have confirmed their reputation, garnering the additional award of Scrooge-of-the-year-so-far, by withdrawing their charity credit cards after 23 years of operating them. Charity credit cards, which are still offered by other providers such as MBNA and the Cooperative Bank, work by donating a small percentage of the amount spent on them to charity. Typically the charity also receives a larger amount th first time that the card is used.

Their reason? Because it is uneconomical. Yes, well charity rarely is profitable, but if that is the only reason you have got, then one has to question why it was done in the first place.

But not to fear, because Lloyds say they will help charities to find other card issuers who will gladly accept the card business that Lloyds says is unprofitable. As though any other company would be so stupid.

Tuesday, 24 January 2012

2 problems solved for the price of 1: #94

So the bishops think that a cap on the level of welfare benefits may be very harmful to one or two families who may be forced to move house as a result. Now I agree that is unfortunate, but people are forced to move house all the time when there circumstances are reduced. The bihops say that a change in housing may have a long term impact on the development of children, as though most of us don't move house from time to time, including members of the ordained clergy who seem to manage a change of surroundings every several years.

However in the interests of everybody's welfare might I suggest that there is a solution, at no cost to the public purse that can be provided by the bishops themselves, for many of them are in possession of ample family friendly accommodation suitable for any displaced families. The bishops of Bath & Wells (above) and Winchester below have additional space for tented accommodation if necessary.

Surprisingly the Bearded Wonder of Lambeth Palace (below) has been strangely quiet when he would normally be speaking up against the government. Can it be that he is actually toeing the line of the Labour Party once again?

However in the interests of everybody's welfare might I suggest that there is a solution, at no cost to the public purse that can be provided by the bishops themselves, for many of them are in possession of ample family friendly accommodation suitable for any displaced families. The bishops of Bath & Wells (above) and Winchester below have additional space for tented accommodation if necessary.

Surprisingly the Bearded Wonder of Lambeth Palace (below) has been strangely quiet when he would normally be speaking up against the government. Can it be that he is actually toeing the line of the Labour Party once again?

Monday, 23 January 2012

Iain Dunkin Stupid

For all its good points, democracy has its weaknesses. One is the fact that despite supposed power of the people to make informed choices, some surprisingly inept people get very close to getting their hands on the levers of power. Whatever convinced John Prescott that he could actually improve the state of the nation is beyond me, and how he actually came to be running the government for a few weeks at a time is now a historical fact that will baffle future researchers.

But sadly, there is not much more that can be said about IDS. He has a military bearing that endears him to certain Conservative Party members, and it has to be said that he is well meaning and public spirited, but some times the quiet man really ought to shut up.

A prime example came on the BBC this morning. The usual interrogation of Conservative ministers occurred, this time with Evan Davies quizzing the former nearly prime minister (well probably not that close) about how many families would be reduced to poverty by today's reduction in welfare benefits.

After a minute or so of bluster that sounded like evasion from IDS, the BBC man just raised his voice, but for the benefit of both parties here is the answer.

The standard definition of poverty, actually relative poverty, is a household income equal to 60% of the median income or below. The welfare changes propose to cap benefits at £26,000 after tax which is the equivalent of somewhere around £32,000-35,000 ( the exact figure depends on who you listen to). £35,000 is about 50% more than the mean household income, which in turn is higher than than the median, which is obviously higher than 60% of the median income.

So the net result is than none of the families affected by the cap is anywhere near the poverty threshold.

But sadly, there is not much more that can be said about IDS. He has a military bearing that endears him to certain Conservative Party members, and it has to be said that he is well meaning and public spirited, but some times the quiet man really ought to shut up.

A prime example came on the BBC this morning. The usual interrogation of Conservative ministers occurred, this time with Evan Davies quizzing the former nearly prime minister (well probably not that close) about how many families would be reduced to poverty by today's reduction in welfare benefits.

After a minute or so of bluster that sounded like evasion from IDS, the BBC man just raised his voice, but for the benefit of both parties here is the answer.

The standard definition of poverty, actually relative poverty, is a household income equal to 60% of the median income or below. The welfare changes propose to cap benefits at £26,000 after tax which is the equivalent of somewhere around £32,000-35,000 ( the exact figure depends on who you listen to). £35,000 is about 50% more than the mean household income, which in turn is higher than than the median, which is obviously higher than 60% of the median income.

So the net result is than none of the families affected by the cap is anywhere near the poverty threshold.

Friday, 20 January 2012

Phoney tax cases

A well respected City tax adviser once explained to me how tax litigation works with big companies. The tax payer and the tax authorities square up to each other and state their positions. Each party takes advice and the advice given to both parties by their respective advisers will be broadly similar, although the adviser naturally talks up his sides chances of success. Just a tad.

But then each party takes a view of their chances of winning and, particularly in the case of the tax authorities, they will go to court to push the envelope or to make a point. The trouble is nobody has told the judge what the answer should be. The case starts in the lower courts and works its way up as bumbling fools miss the points or eager young 50 year olds try to make a name for themselves by over-interpreting judgements from the higher courts, but eventually after many years the case rises to a level of court of sufficient competence to come to the correct conclusion - although in some cases the parties run out of courts.

It seems the UK is not alone in this system, with the Indian courts following a similar approach because India’s supreme court has found in favour of Vodafone in dispute with the Indian tax authorities over a capital gains $2.9bn tax bill plus $1.5 billion of interest and penalties.

The idiocy of the Indians' position takes a little explaining.

Vodafone spent $10.9bn to acquire Hutchison Essar, an Indian telecoms company, in 2007 from its Hong Kong based parent, Hutchinson Whampoa. Only it didn't acquire the shares directly. A Dutch resident subsidiary of Vodafone Group plc acquired Hutchison Telecommunications International Ltd’s stake in Hutchison Essar Ltd, which it owned through a Cayman Island company.

The capital gain thus arose in the Cayman Island subsidiary of Hutchison. Now Indian law says that when an Indian seller realises a capital gain, the purchaser may be liable for the tax on the capital gain (on the basis that the purchaser who is liable may have done a runner offshore but the acquirer of the Indian assets has something that they can get there hands on.

The gist of the Vodafone argument was that since the sale and purchase took place between entities outside India there was no Indian tax payer realising a gain. Looking at the Indian companies in isolation, nothing happened. The transaction took place at a higher level.

Vodafone's further argument was that it was not their liability but Hutchison, which makes perfect sense to me even if it didn't seem that way to the Indian income tax department.

Fortunately for good sense, the Indian Supreme Court passed the judgement in favour of Vodafone, saying that the Indian Income tax department had "no jurisdiction" to levy tax on overseas transaction between companies incorporated outside India

The irony is that the decision makes it more likely that Vodafone will now proceed with an IPO of part of its Indian business, which the Vodafone CEO has said would happen only if the appeal was successful. Which should generate some more capital gains.

Thursday, 19 January 2012

On your Sopa box

So yesterday a whole lot of fairly useful websites went black in protest against some US legislation that was never going to happen.

The big fuss, which none of the objectors really seems to be able to get their heads around and explain satisfactorily is that hte US intends to act against websites that link to websites handing out copyright material.

In as far as it goes I have no objection to that. If a bunch of what in my younger days we would call "grown-ups" decide that they can usefully spend their days singing, writing, or prancing about in front of a camera and a whole bunch of other people think they can take their output and sell it, then I have no problems either about them doing so or being able to protect their interests.

Oh but this is wrong say the protesters. This could be the death of free speech as Big Media goes around shutting sites down.

Which is basically nonsense. First of all complainants have to get a court order (i.e. a judge has to make a decision in their favour based on evidence) and then they are potentially liable for damages if they make a false accusation.

Sure enough it doesn't stop firms with very deep pockets making frivolous claims, but Apple have been trying to tie their competition in knots that way for years, and the fact that the US is trying to reach overseas, and potentially drag foreign companies into US law. Well there is nothing new in that. Ask the NatWest 3 who were extradited to the US without a shred of evidence being produced and at their extradition hearing were coerced into accepting a guilty plea bargain making a rational decision on probabilities and pay-offs including the non-refundable cost of defence in the US court system.

Which is all typical of the young woolly liberal protesters today (think Occupy LSX) - wrong target and wrong form of protest. The only people inconvenienced by their protest were their website users. The targets of their protest didn't see them and frankly didn't care.

The big fuss, which none of the objectors really seems to be able to get their heads around and explain satisfactorily is that hte US intends to act against websites that link to websites handing out copyright material.

In as far as it goes I have no objection to that. If a bunch of what in my younger days we would call "grown-ups" decide that they can usefully spend their days singing, writing, or prancing about in front of a camera and a whole bunch of other people think they can take their output and sell it, then I have no problems either about them doing so or being able to protect their interests.

Oh but this is wrong say the protesters. This could be the death of free speech as Big Media goes around shutting sites down.

Which is basically nonsense. First of all complainants have to get a court order (i.e. a judge has to make a decision in their favour based on evidence) and then they are potentially liable for damages if they make a false accusation.

Sure enough it doesn't stop firms with very deep pockets making frivolous claims, but Apple have been trying to tie their competition in knots that way for years, and the fact that the US is trying to reach overseas, and potentially drag foreign companies into US law. Well there is nothing new in that. Ask the NatWest 3 who were extradited to the US without a shred of evidence being produced and at their extradition hearing were coerced into accepting a guilty plea bargain making a rational decision on probabilities and pay-offs including the non-refundable cost of defence in the US court system.

Which is all typical of the young woolly liberal protesters today (think Occupy LSX) - wrong target and wrong form of protest. The only people inconvenienced by their protest were their website users. The targets of their protest didn't see them and frankly didn't care.

Sunday, 15 January 2012

Crony capitalism

So the Miliband who is currently running the Labour Party (can't remember which one that is, they all look the same to me) thinks crony capitalism is a bad idea and so it is, so credit where it is due.

But why do I hear the words Drayson, Powderject and vaccines in my head? Or Benneton, Mills/Jowell, Ecclestone, F1 smoking ad ban?

Then again sometimes it goes Sugar, Viglen, public sector PC purchases, while at other times those same voices are saying Lakshmi Mittal & letters to the Romanian Government, or "Sir" Gulam Noon, or sometimes just plain "Hinduja passport" or "Union modernisation fund".

But why do I hear the words Drayson, Powderject and vaccines in my head? Or Benneton, Mills/Jowell, Ecclestone, F1 smoking ad ban?

Then again sometimes it goes Sugar, Viglen, public sector PC purchases, while at other times those same voices are saying Lakshmi Mittal & letters to the Romanian Government, or "Sir" Gulam Noon, or sometimes just plain "Hinduja passport" or "Union modernisation fund".

Friday, 13 January 2012

Public sector sick pay

The new boss at Lloyds has announced that his is to waive the 225% performance bonus that he might have been eligible to receive for his management of the 41% tax payer owned bank.

Which is big of him, but considering he has been in the post since March of last year and took a 2 month sickie for stress-related illness, in my book he can consider himself fortunate that he gets to keep all of his £1,060,000 base salary.

But the in the public sector, taking 40 days sick leave is nothing special. He will probably still claim his 28 days annual leave plus the statutory bank holidays, so all in all, in erms of pay for days work actually done, it doesn't look so bad after all.

Which is big of him, but considering he has been in the post since March of last year and took a 2 month sickie for stress-related illness, in my book he can consider himself fortunate that he gets to keep all of his £1,060,000 base salary.

But the in the public sector, taking 40 days sick leave is nothing special. He will probably still claim his 28 days annual leave plus the statutory bank holidays, so all in all, in erms of pay for days work actually done, it doesn't look so bad after all.

Ooh, AAA, M. le President

So Eric Cantona fancies his chances of getting to the Elysee Palace.

That should liven up those informal G20 meetings and negotiation os the eurozone.

Just the sort of attitude to put paid to the negative thinking at S&P.

That should liven up those informal G20 meetings and negotiation os the eurozone.

Just the sort of attitude to put paid to the negative thinking at S&P.

Wednesday, 11 January 2012

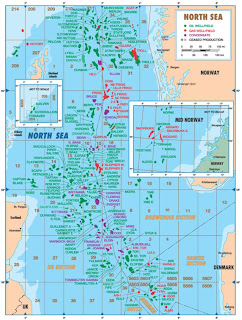

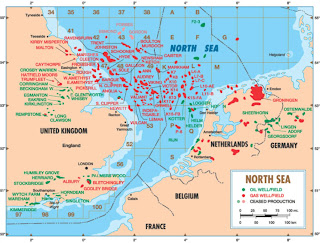

Scottish oil rights

The extraction rights and licenses over oil in the North Sea (let's ignore gas for the moment which is mostly offshore from England) are claimed by the United Kingdom and agreed by treaty even though most of the area claimed lies outside UK territorial waters.

It seems a little presumptuous to think that just by claiming independence that any of this money would revert to a new Scottish government. The rights are all granted by the Crown and royalties are paid pursuant to licensing agreements. It seems to me that the UK government would have little interest in assigning those rights and in the absence of any amendments to treaties it would be quite entitled to maintain its interest in any oil fields outside Scottish territorial waters.

The point is that a country is usually entitled by international agreements to the mineral rights oin its half of the median line between two countries. The median line in the North Sea was reached by negotiation between the parties involved. Scotland was not one of the parties involved in the treaty negotiations over the North Sea, so if it did secede from the United Kingdom and was not a signatory to any treaty, I doubt that it would have any rights under international law over those oil fields.

And we can hang onto them. If the Scots want to take them they would have to send the navy that they haven't got.

The fields in the Southern North Sea are all gas fields and have nothing to do with Scotland. When a Scot tells you that the UK government has taken £186 billion from the North Sea, it is worth pointing out that a lot of that number comes from the "English" gas fields below plus Morecambe Bay.

It seems a little presumptuous to think that just by claiming independence that any of this money would revert to a new Scottish government. The rights are all granted by the Crown and royalties are paid pursuant to licensing agreements. It seems to me that the UK government would have little interest in assigning those rights and in the absence of any amendments to treaties it would be quite entitled to maintain its interest in any oil fields outside Scottish territorial waters.

The point is that a country is usually entitled by international agreements to the mineral rights oin its half of the median line between two countries. The median line in the North Sea was reached by negotiation between the parties involved. Scotland was not one of the parties involved in the treaty negotiations over the North Sea, so if it did secede from the United Kingdom and was not a signatory to any treaty, I doubt that it would have any rights under international law over those oil fields.

And we can hang onto them. If the Scots want to take them they would have to send the navy that they haven't got.

Tuesday, 10 January 2012

On Scottish independence

So the Scots want independence and they think that they can just vote on the matter and walk away from the United Kingdom. Well, if that's what they want to do, then I am not going to try to stop them and I will be quite happy to see the back of the Barnett formula.

I am not particularly fussed about losing any oil revenue because total offshore oil and gas receipts to the Treasury since North Sea oil started flowing amount to £163 billion or just under £4 billion a year. But bear in mind that a lot of that comes from the English side, particularly the gas which is much more profitable than oil. The field that pays the most PRT is the Centrica owned Morecambe Bay field which operates 6 platforms often manned by 2 people (for all 6). Compare that with the cohorts who operate the deep water oil platforms and the cost differential is obvious.

Add to that the fact that North Sea Oil has to compete with Middle East oil that costs a quarter of the price to get out of the ground while until recently the only serious competition for UK gas has been Siberian gas pumped halfway round the world, and it becomes obvious that while oil offshore from Scotland may have supported the eastern half of the Scottish economy for many years it hasn't been a cash cow to the Treasury on the scale that most Scots believe, and has a much smaller impact than the City or the UK pharmaceutical industry.

Net income to the Treasury from Scottish oil receipts probably do not cover the transfers in the other direction, and that disregards the fact that the oil industry is simply doing what the rest of the UK commercial economy does - paying its way by paying taxes on its profits.

But before the Scots think they can just walk away, here are some points the rest of the UK might want to consider.

Tax

I am not particularly fussed about losing any oil revenue because total offshore oil and gas receipts to the Treasury since North Sea oil started flowing amount to £163 billion or just under £4 billion a year. But bear in mind that a lot of that comes from the English side, particularly the gas which is much more profitable than oil. The field that pays the most PRT is the Centrica owned Morecambe Bay field which operates 6 platforms often manned by 2 people (for all 6). Compare that with the cohorts who operate the deep water oil platforms and the cost differential is obvious.

Add to that the fact that North Sea Oil has to compete with Middle East oil that costs a quarter of the price to get out of the ground while until recently the only serious competition for UK gas has been Siberian gas pumped halfway round the world, and it becomes obvious that while oil offshore from Scotland may have supported the eastern half of the Scottish economy for many years it hasn't been a cash cow to the Treasury on the scale that most Scots believe, and has a much smaller impact than the City or the UK pharmaceutical industry.

Net income to the Treasury from Scottish oil receipts probably do not cover the transfers in the other direction, and that disregards the fact that the oil industry is simply doing what the rest of the UK commercial economy does - paying its way by paying taxes on its profits.

But before the Scots think they can just walk away, here are some points the rest of the UK might want to consider.

Economy

It would be

unacceptable to think that an independent Scotland could free itself from its share of the National Debt. Any independence

settlement would have to include an obligation on the Scottish government to

raise sufficient funds to pay an amount equal to 10% of the National Debt to HM Treasury. This might not be possible immediately on

independence, so the UK Government should charge interest on the unpaid balance and take suitable security, such as an

assignment of revenues from North Sea oil fields until the amount has been paid in full..

Similarly,

it would be unacceptable for the residual UK Treasury to continue to fund

either State pensions or the pensions of public sector workers resident in

Scotland, and an agreement acceptable to the rest of the United Kingdom would

be needed.

Banking

Banking

The UK government (or tax payer) has

incurred considerable expenditure (£75 billion or thereabouts at the last count) on the purchase of shares in HBOS/Lloyds and

RBS. There is no particular reason to consider that the ownership of

those shares should vest in an independent Scottish government rather than HM Treasury

which actually bought the shares. It would be appropriate for the majority owner to transfer the headquarters of those companies south of the border.

Some changes of name might be appropriate, perhaps to Lloyds Halifax and the Royal Bank of the United Kingdom?

Tax

It would of course be quite unacceptable for any nominal Scots resident in the residual United Kingdom to bung their savings offshore and claim non-domicile status so that any offshore income falls

outside the scope of UK taxation.

Similarly,

any acceptable settlement would require provisions in the UK tax code to

prevent predatory activities against the UK corporate tax base, including the

non-deductibility of management expenses and similar payments made to Scottish

resident companies by their UK subsidiaries.

Defence

We wouldn't like our new neighbours to be able to offer third countries a

forward base from which to launch attacks against the rest of the island, a

problem resolved 400 years ago by the Act of Union. In addition

to the UK equivalent of the Munro Doctrine, the only

acceptable short term solution would be the retention by the United

Kingdom of so many military bases and assets in Scotland as the United Kingdom saw fit,

until such time as the United Kingdom chooses to relinquish them. The Scots may not like it but when you live next door to a nuclear power 10 times your size you can't have it all your own way.

Environment

Because the SNP

sees itself likely to expand its links with the rest of the Celtic fringe and

Scandinavia, there is a reduced need for transport links between our countries,

which are costly to maintain.

I suggest that this means that the northbound carriageway of the downgraded C74 could be reduced to a single track with passing places while the southbound carriageway would be reopened as a combination of cycle route and natural corridor along which wide-ranging animals can travel, plants can propagate, genetic interchange can occur, populations can move in response to environmental changes and natural disasters, and threatened species can be replenished from other areas.

I suggest that this means that the northbound carriageway of the downgraded C74 could be reduced to a single track with passing places while the southbound carriageway would be reopened as a combination of cycle route and natural corridor along which wide-ranging animals can travel, plants can propagate, genetic interchange can occur, populations can move in response to environmental changes and natural disasters, and threatened species can be replenished from other areas.

Transport

While the

foregoing environmental measure might be detrimental to certain areas in the

North of England, the economic impact could be mitigated or reversed by the

construction of a further high speed rail link (HS3) to Carlisle and

Berwick-upon-Tweed. HS3 would be relatively expensive, but the cost could

be met entirely from the annual savings in transfers from London to Edinburgh.

Monday, 9 January 2012

Senior bankers spouting off

A meeting of central bank regulators at the BIS in Basel has concluded that banks will be required to hold emergency stocks of liquid assets starting in 2015 .

The central bankers and regulators from 27 major economies rejected industry pleas for a delay or substantial rewrite of the controversial planned “liquidity coverage ratio” that will require banks to hold buffers against a 30-day market crisis. Bankers say it will constrain lending, harm economic growth and make the banking system vulnerable to sovereign debt issues.

The answer to that is that it just means the banks need more capital, so the returns are lower, which means that the bank management will have to be paid less because they won't be making the same return on capital.

The central bankers and regulators from 27 major economies rejected industry pleas for a delay or substantial rewrite of the controversial planned “liquidity coverage ratio” that will require banks to hold buffers against a 30-day market crisis. Bankers say it will constrain lending, harm economic growth and make the banking system vulnerable to sovereign debt issues.

The answer to that is that it just means the banks need more capital, so the returns are lower, which means that the bank management will have to be paid less because they won't be making the same return on capital.

Tuesday, 3 January 2012

My answer

Following the totally overwhelming response to yesterday's little puzzle, here is my solution. Please feel free to kick holes in it.

|

| Start with a line, any line. Lets call the left end A and the right end B |

|

| Adjust the compass us to the length of the line and draw 2 circles, centred on A and B |

|

| We now draw 2 more lines (purple), each one being drawn from the centre of these new circles to the point where that circle intersects the other red line (and not the black line AB) |

Maths problem

For the benefit of those still in Christmas/New Year quiz mode, here is a simple mathematical problem: can you cut a line into 3 equal parts simply using a compass and a straight edge? This means no assumed angles (e.g. parallel, perpendicular) unless created by construction.

There are plenty of versions of how to solve this, but can you come up with one with a self evident proof which doesn't require any complicated trigonometric calculations to prove its correctness?

Hint, a proof using similar triangles in simple proportions would not be "complicated" for these purposes.

There are plenty of versions of how to solve this, but can you come up with one with a self evident proof which doesn't require any complicated trigonometric calculations to prove its correctness?

Hint, a proof using similar triangles in simple proportions would not be "complicated" for these purposes.

Subscribe to:

Posts (Atom)